In 2013, O Neal bought a 3% stake in the Kings for 5 million. How much is it worth selling now?

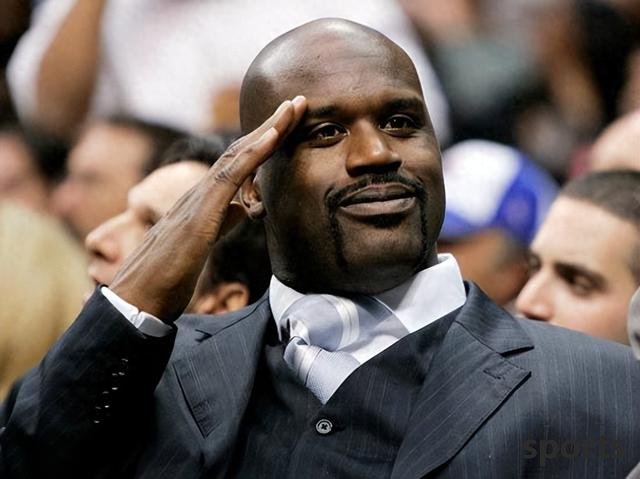

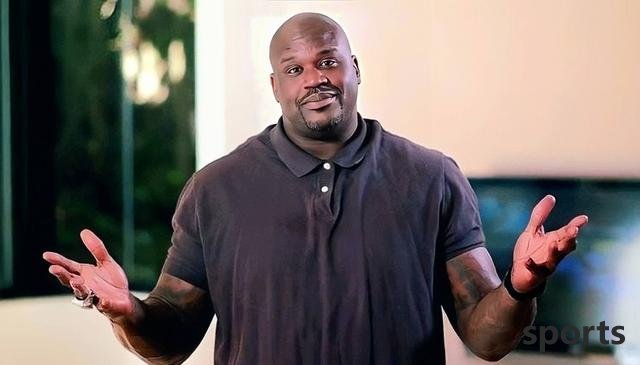

As we all know, there are many NBA players who go bankrupt after retirement, including former superstars such as Iverson and Pippen. But there are also many people with excellent business acumen and investment vision. With the wealth accumulated during their time as players, they further expanded their business empire after retirement, and the "Big Shark" O'Neal is one of them. Don't look at O'Neal's big and thick-sized careers, in fact, his business acumen is no less than Jordan and James. After retiring, he served as TNT commentator for an annual salary of up to US$10 million. His investment areas also cover many industries such as catering, real estate, and technology. Investment in Google's original shares has made him rewarded generous returns. In 2013, O'Neal bought a 3% stake in the Kings for $5 million. This investment did not attract much attention at the time, but over time, the investment made him a lot of money. In fact, almost all NBA players have the dream of owning a team after retirement. Although only Jordan has truly achieved this, many stars still work hard for it. In 2013, when Ranadave bought 65% of the Kings from the Maluf brothers for $534 million, O'Neal also seized the opportunity and bought 3% of the Kings for $5 million, becoming the team's minor shareholder. Although the Kings had not made the playoffs in ten years, O'Neal still spared no effort to help the team. Not only did he frequently attend the Kings' games to increase exposure, but he also made a careful plan for Cousins at the peak of his time. So to this day, how much has O'Neal's 3% stake appreciated? In 2013, the Kings' market value was not high. Although the price of $534 million seemed not low at the time, it seemed insignificant compared to the valuation of today's NBA teams. In 2016, the Kings launched a new home court, the Golden One Stadium, which greatly enhanced the team's market value. Since then, the Kings' valuation has been rising. In 2022, the Kings' market valuation has reached US$2.32 billion. However, this is not the end of the Kings' valuation. In 2023, the overall market environment of the NBA continued to improve, and the Kings' valuation further rose. According to Forbes' March 2025 data, the Kings' valuation has reached $3.7 billion. This means that O'Neal's 3% stake, if calculated at this valuation, has reached US$110 million. But in 2022, O'Neal was forced to sell his equity due to violating relevant regulations. At the beginning of 2022, O'Neal became the spokesperson for a gambling platform. According to relevant NBA regulations, team shareholders are not allowed to hold both team equity and gambling company shares, so he was forced to sell 3% of the Kings' equity by the league. According to US media reports, the sale of shares made O'Neal make about $6 million in profits. In the eyes of many fans, O'Neal's move can be said to have picked up sesame seeds and lost watermelons. After all, continuing to hold these shares will inevitably be a long-term profit. However, for O'Neal, whose personal assets have reached $1 billion, these are actually nothing.

- Recent Posts

-

- Just today! On the morning of

- Edwards & Hughes posted a

- 1-3 Desperate situation! The t

- Thunder returns to the finals

- Love will be bought out by the

- The defending champion is down

- Don’t go to the CBA! Wang Junj

- Being scolded when joining the

- Substitute lost 8 points and 1

- Durant said that it is difficu

- Hot Posts

-

- How strong is the strongest hi

- Yang Hansen tried out the Warr

- NBA rumor: Kevin Durant believ

- Looking forward! 2025-2026 NBA

- Anthony is rated as the strong

- Replica Legend, Thunder Alexan

- Data analysis: Pacers 2-1 Thun

- NBA Summer United: Yang Hansen

- Yang Hansen s rookie contract

- Magic vs. Free throws: Hallibu

- Durant is destined to join the

- There are good and bad! Team m

- Which NBA team is more suitabl

- NBA character Alexander: The T

- Behind SGA’s Give Up 100 milli

- Hit 10+4+5+3! Yang Hansen made

- After Westbrook jumped out of

- The NBA playoff division final

- After Bill reached a buyout, t

- 2025 Rookie Observation (20):

- search

-

- Links

-